conocophillips stock long term forecast

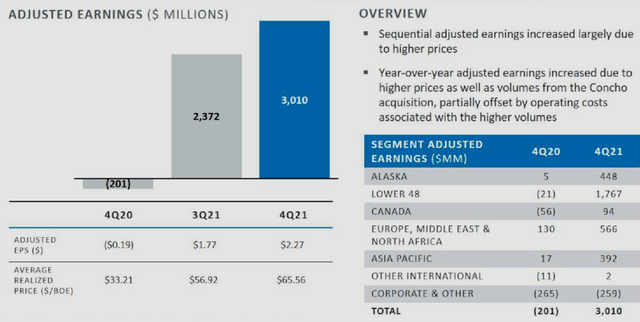

ConocoPhillips Q4 21 adjusted EPS of 227 easily. Your current 100 investment may be up to 11122 in 2027.

Conocophillips Stock A Grey Swan In Motion Nyse Cop Seeking Alpha

During that period the price should oscillate between.

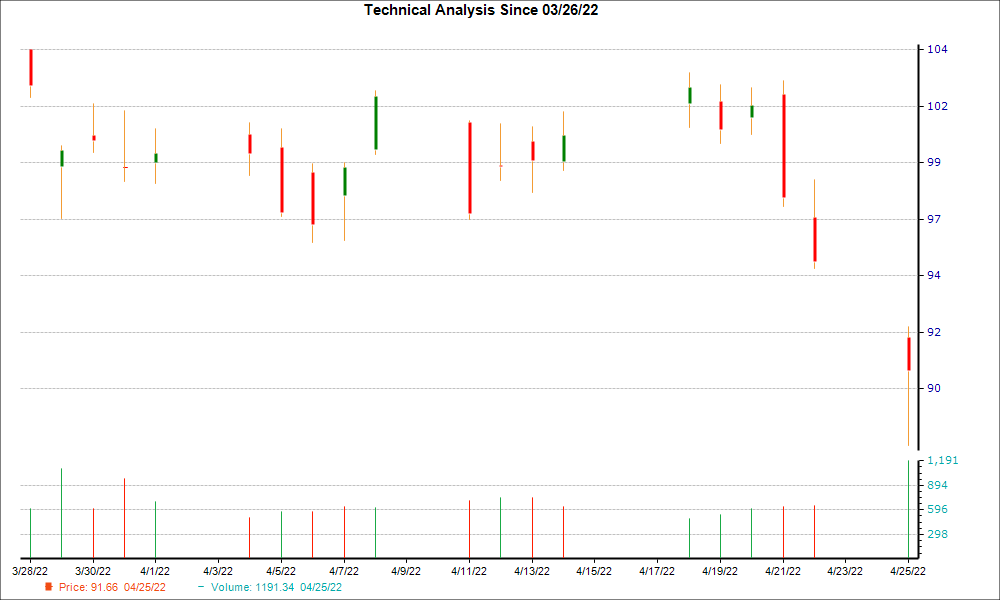

. Find the latest ConocoPhillips COP stock quote history news and other vital information to help you with your stock trading and investing. According to latest technical analysis ConocoPhillips stock forecast for 2022 is 9602 forecast for 2023 is 11284 forecast for 2024 is 12017. Forecast target price for 05-04-2022.

During the day the stock fluctuated 581 from a day low at 8877 to a day high of 9393. ConocoPhillips last released its earnings data on February 3rd 2022. With a 5-year investment the revenue is expected to be around 1122.

Eight analysts revised their earnings estimate upwards in the last 60 days for fiscal 2022. In the short term 2weeks COPs stock price should underperform the market by -002. Conoco Phillips COP stock price prediction is 13766630278641 USD.

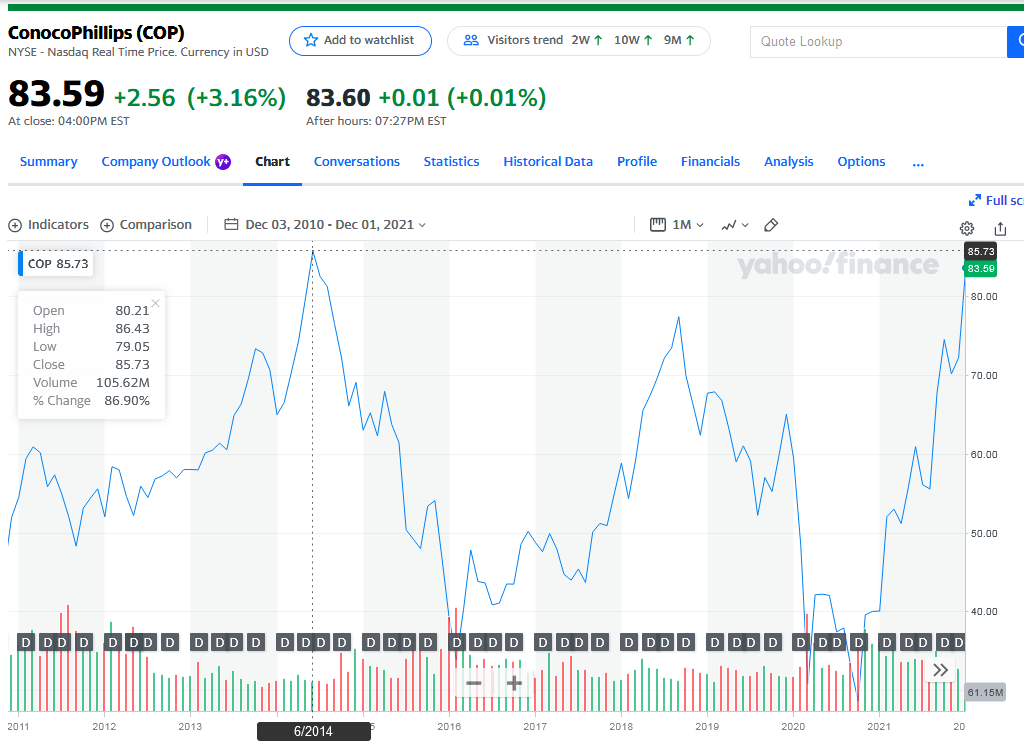

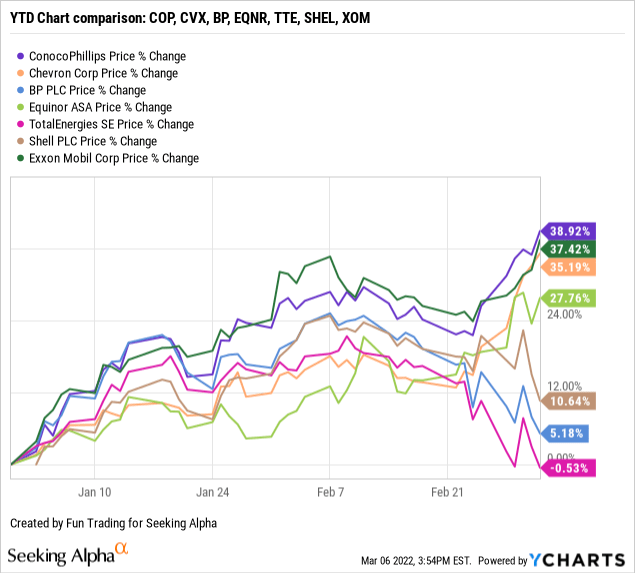

22 2018 when the stock price was at 7200. The company is a long-term oil investment comparable to my. The sector is outperforming thus far in 2022 with a gain of 323.

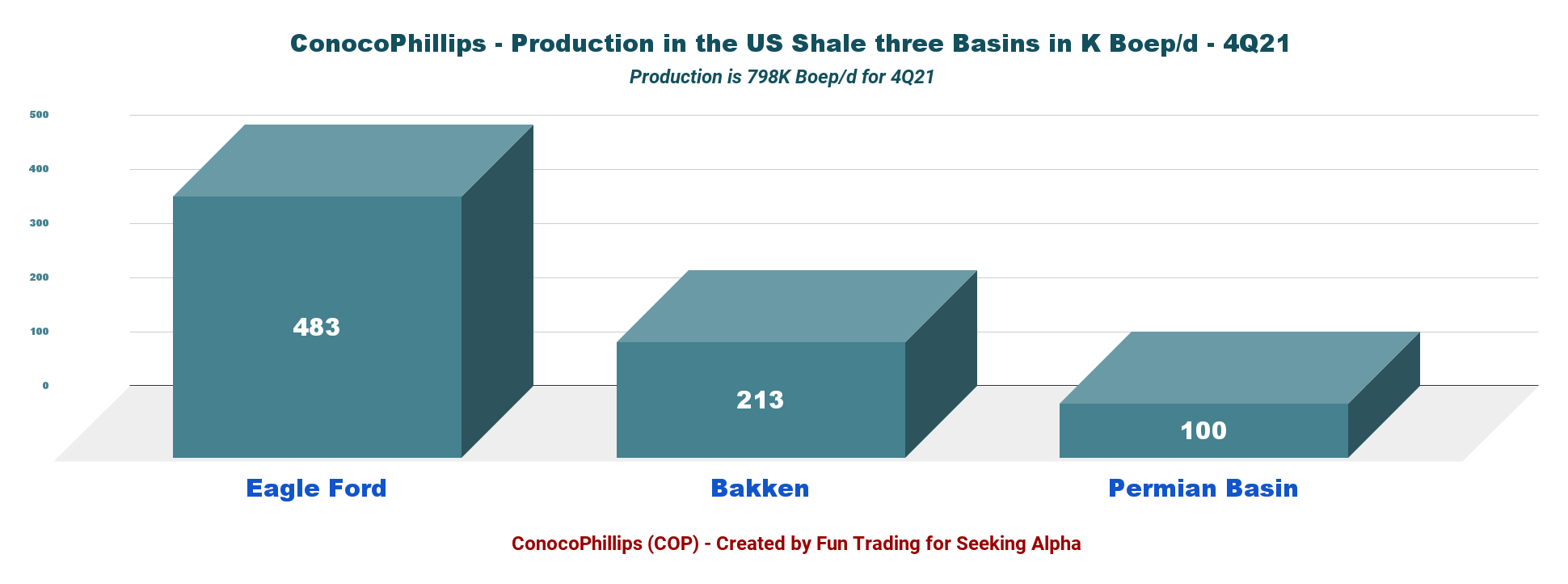

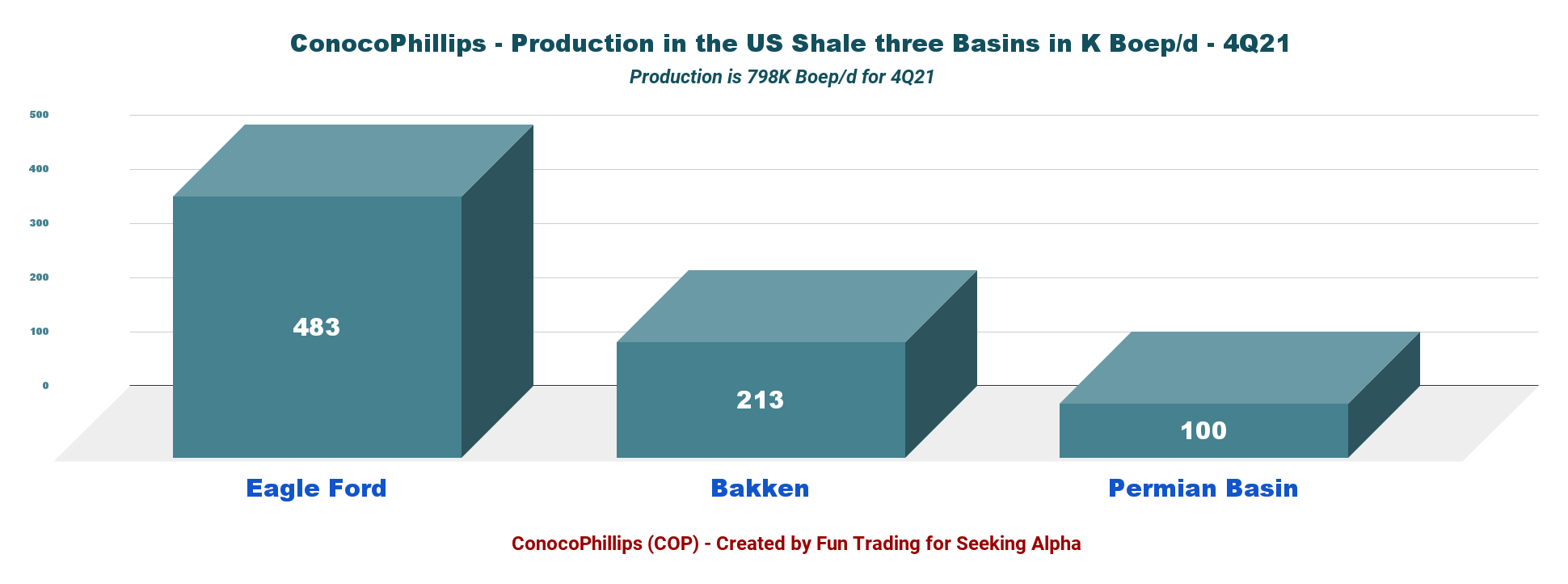

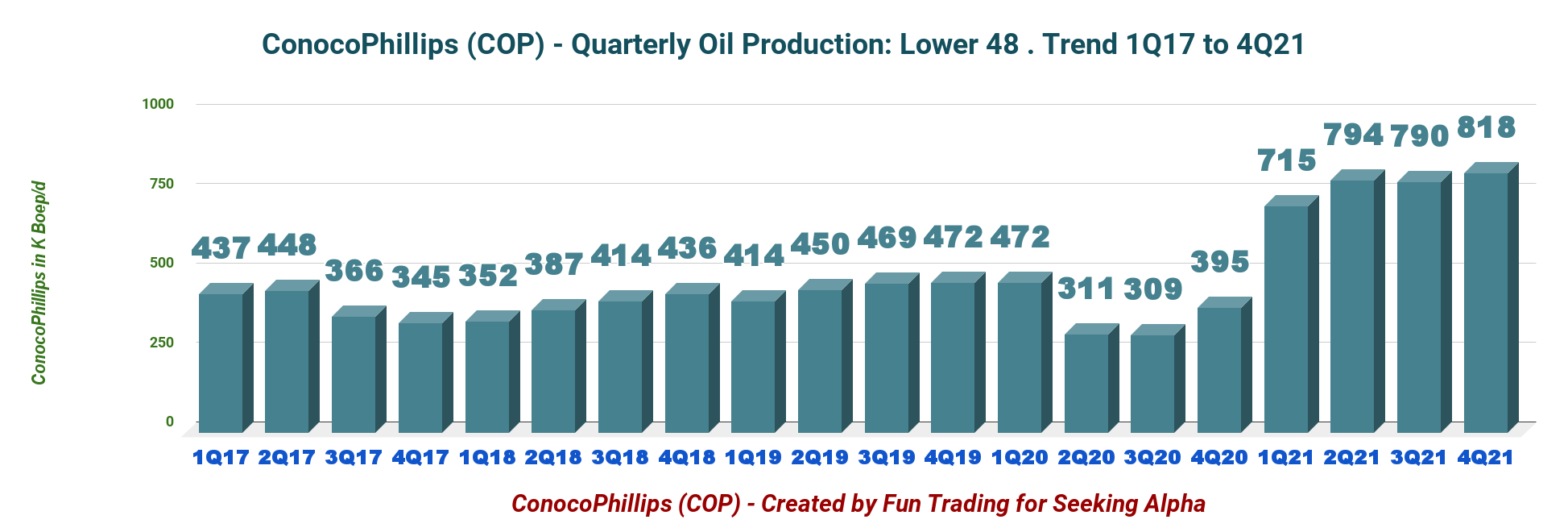

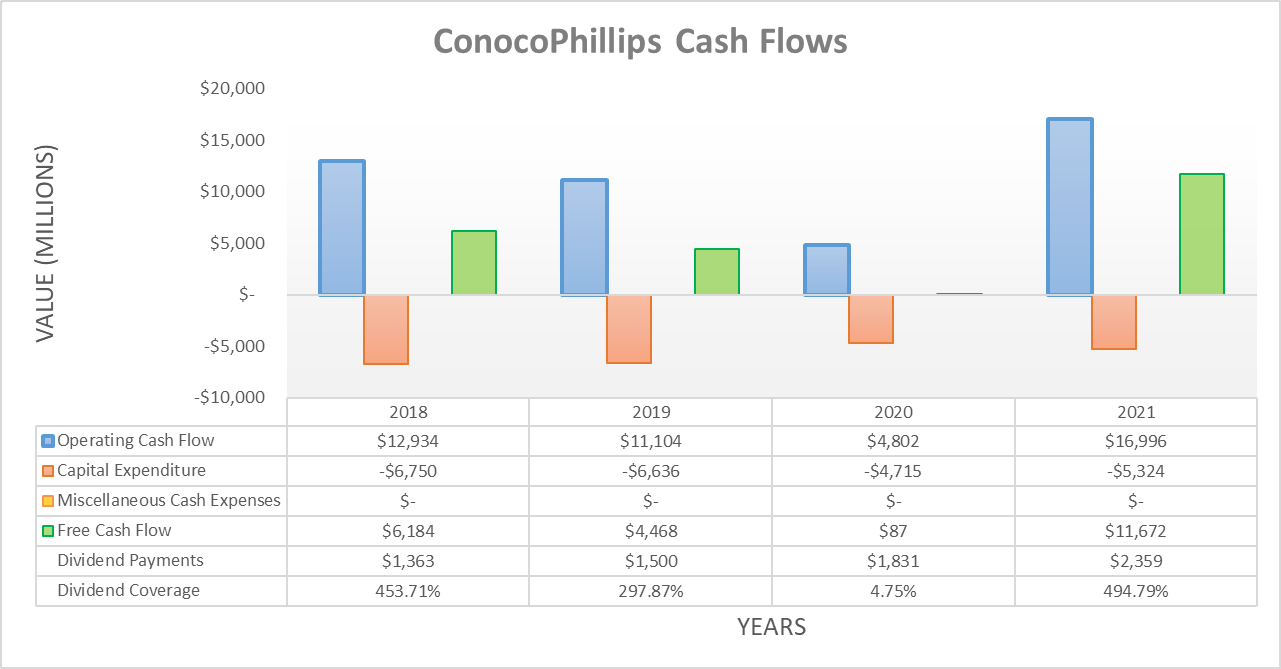

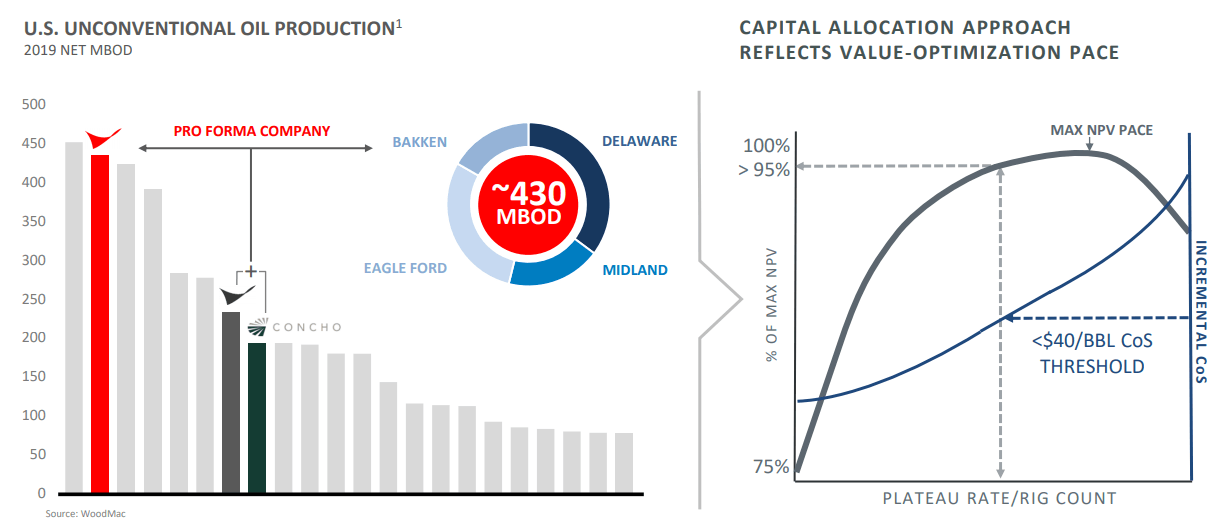

The price has been going up and down for this period and there has been a -695 loss for the last 2 weeks. Jan 14 2021 900AM EST. Production excluding Libya averaged 1488 MBOED for the three months ended March 31 2021 and proved reserves were 45 BBOE as of Dec.

Price to Earnings Ratio vs. During the day the stock fluctuated 581 from a day low at 8877 to a day high of 9393. This is 191 more than the trading day before Tuesday 26th Apr 2022.

Earnings for ConocoPhillips are expected to decrease by -1093 in the coming year from 1253 to 1116 per share. ConocoPhillips COP shares have jumped 328 in the year-to-date period. And 424368 USD for 2027 April 24 Saturday with technical analysis.

It also outperformed in 2021 with a gain of 477. Conoco Phillips Stock Forecast for 2022. COP stock forecast Our latest prediction for Conoco Phillipss stock price was made on the Aug.

The ConocoPhillips stock price gained 191 on the last trading day Wednesday 27th Apr 2022 rising from 9132 to 9306. -551 ConocoPhillips Stock Price Forecast for 2023. Long term indicators are suggesting an average of 100 Buy for it.

In contrast when we review COP stocks current outlook then short term indicators are assigning it an average of 50 Buy while medium term indicators are categorizing the stock at an average of 50 Buy. ConocoPhillips has risen higher in 32 of those 49 years over the subsequent 52 week period corresponding to a historical accuracy of 6531 Is ConocoPhillips Stock Undervalued. It underperformed in 2020 with a loss of 373 and in 2019 with a gain of.

101 rows Close price at the end of the last trading day Wednesday 27th Apr 2022 of the COP stock was 9306. The firm earned 1596 billion during the quarter compared to. Positive dynamics for ConocoPhillips shares will prevail with possible volatility of 1191.

The Zacks Consensus Estimate has increased 139 to 974 per share. Our system considers the available information about the company and then compares it to all the other stocks we have data on to get a percentile-ranked value. The 5 Wall Street analysts offering ConocoPhillips stock forecast in the last 6 months have average price target of 910 with a high forecast of 1000 and a low forecast of 770.

The average ConocoPhillips stock forecast represents a 886 increase from the last price of 835899963378906. Based on our forecasts a long-term increase is expected the COP stock price prognosis for 2027-04-13 is 112851 USD. Conoco Phillips quote is equal to 101465 USD at 2022-04-19.

Over the next 52 weeks ConocoPhillips has on average historically risen by 108 based on the past 49 years of stock performance. According to 34 analysts the average rating for COP stock is Buy The 12-month stock price forecast is 11906 which is an increase of 2401 from the latest price. Conocophillips COP gets an Overall Rank of 73 which is an above average rank under InvestorsObservers stock ranking system.

009 ConocoPhillips Stock Price Forecast for 2023. Despite a solid forecast for 2022 with revenues and cash. The energy producer reported 227 EPS for the quarter beating analysts consensus estimates of 220 by 007.

The Conoco Phillips stock forecast is 13766630278641 USD for 2023 April 24 Monday. ConocoPhillips Stock Forecast 05-04-2022. While the upstream energy industry is grappling with coronavirus woes the company has managed.

COP boasts an average earnings. ConocoPhillips Stock Price Forecast for 2023. The PE ratio of ConocoPhillips is 1673 which means that it is trading at a more expensive PE ratio than the market average PE ratio of about 1171.

Stock Price Forecast The 26 analysts offering 12-month price forecasts for Conocophillips have a median target of 12100 with a high estimate of 15000 and a low estimate of 9900.

Conocophillips Stock Forecast Will Cop Keep Rising

Conocophillips Stock A Grey Swan In Motion Nyse Cop Seeking Alpha

Conocophillips Stock Forecast Will Cop Keep Rising

Conocophillips Stock Remains A Good Energy Sector Bet Nasdaq

Conocophillips Stock A Grey Swan In Motion Nyse Cop Seeking Alpha

Conocophillips Stock Closing In On A 7 Year All Time High Nyse Cop Seeking Alpha

Conocophillips Stock Forecast Will Cop Keep Rising

Conocophillips Stock Forecast Will Cop Keep Rising

Conocophillips Stock High Oil Prices Remain Supportive

Strategic Flexibility And Planning Conocophillips

Conocophillips Potential Higher Future Shareholder Returns Nyse Cop Seeking Alpha

Conocophillips To Acquire Concho Resources In All Stock Transaction Business Wire

Conocophillips Stock A Grey Swan In Motion Nyse Cop Seeking Alpha

Conocophillips The Recent Discovery Highlights Its Strength Nyse Cop Seeking Alpha

Conocophillips Cop Strong Industry Solid Earnings Estimate Revisions

:max_bytes(150000):strip_icc()/cop1-b073882b74894223bf1f765a9fd7b5f7.jpg)